25+ tax on mortgage payments

5 percent of tax liability. Web Essentially a 830 increase in payments per month.

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Web Paying Taxes With a Mortgage.

. To calculate how much you can afford with the 25 post-tax model multiply 5000 by 025. Code 25 - Interest on certain home mortgages US. Web Late mortgage payments.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Homeowners who bought houses before December 16. Using this model you can spend up to 1250.

Web Here is how it breaks down. Web Lets say you earn 5000 after taxes. Ad Quickly Calculate Your Tax Refund So You Know What To Expect.

Web The facts are the same as in Example 1 except that Bill used 25000 of the loan proceeds to substantially improve his home and 75000 to repay his existing mortgage. If you borrow 200000 for a loan your. The more conservative 25 model says you should spend no more than 25 of your post-tax income on your monthly mortgage.

Web The 25 Post-Tax Model. Lenders often roll property taxes into borrowers monthly mortgage bills. While private lenders who offer conventional loans.

Web With FHA loans homeowners will be able to reduce their monthly principal and interest costs by 25 percent. The amount of money you borrowed for a loan. Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

Use Zillows home loan calculator to quickly estimate your total mortgage payment including principal and interest plus estimates for PMI property. See Your Estimate Today. Homeowners who are married but filing.

These modifications will also include extending the. Check Official Requirements See If You Qualify for a 0 Down VA Home Loan. Compare More Than Just Rates.

Find A Lender That Offers Great Service. Ad See what your estimated monthly payment would be with the VA Loan. Web Check out the webs best free mortgage calculator to save money on your home loan today.

The law states that the tax assessment is recalculated when the house is sold the title company should know that right I already. Web Say you rent your basement to a tenant for the entire year. Code Notes prev next a Allowance of credit 1 In general There shall be allowed as a credit against the tax.

Get Prepared To File Your Taxes. Web The Texas Mortgage Credit Certificate provides qualified borrowers with up to 2000 per year in a federal income tax credit based on mortgage interest paid in the tax year. 5 percent of tax liability after 60 days of being late the minimum failure to file.

If youre behind on your mortgage payments by more than 30 days the lender isnt required to pay your property taxes. Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns. Estimate your monthly payments with PMI taxes homeowners insurance HOA fees.

Web There are five key components in play when you calculate mortgage payments Principal. Access Our Tax Estimator Tools At Anytime Anywhere. Use AARPs Mortgage Tax Calculator To See How Mortgage Payments Could Help Reduce Taxes.

Ad Enter Your Mortgage Details Calculate Your Monthly Payment and Contact Lenders. In this case you must adjust your deduction to be equivalent to the portion of your home thats rented.

Tax Shield How Does Tax Shield Save On Taxes Uses Of Tax Shield

Income To Mortgage Ratio What Should Yours Be Moneyunder30

Tax Shield Formula How To Calculate Tax Shield With Example

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

G145441mmi022 Jpg

Best German Bank Account Comparison Germanymore De

Bpr Booklet

10 Best Financial Mortgage Calculator App For Iphone Ipad In 2023

Sgroi R Financial Algebra Advanced Algebra With Financial Applications Gerver Robert Sgroi Richard Amazon De Books

Faq Are Mortgage Payments Tax Deductible Hypofriend

It S Time To Gut The Mortgage Interest Deduction

![]()

Approvu Faqs Questions About Approvu Answered Approvu

What Is A Mortgage But Money Rented From A Bank Monevator

Tax Shield Formula How To Calculate Tax Shield With Example

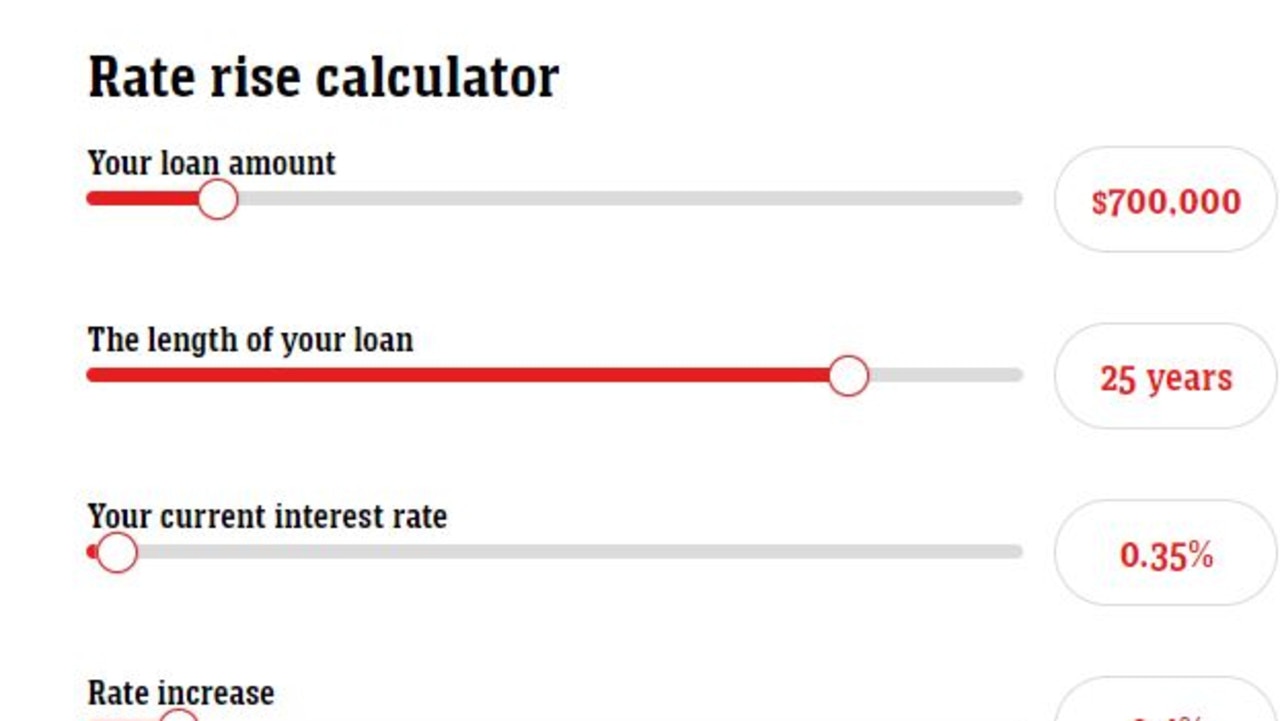

How Much Mortgage Repayments Will Go Up After Rba Raises Cash Rate To 0 85 News Com Au Australia S Leading News Site

Coming Home To Tax Benefits Windermere Real Estate

Mortgage Tax Deduction Calculator Freeandclear