40+ mortgage interest deduction second home

Or 10 of the time you rent it out at the fair market value. 2 before Dec 16 2017 and under 1M.

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Ad Compare Loan Options Calculate Payments Get Quotes - All Online.

. Web The mortgage interest deduction means that mortgage interest paid on the first 1 million of mortgage debt can be deducted from your taxes through 2025. Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process. Web You can deduct mortgage interest on a second home as an itemized deduction if it meets all the requirements for deducting mortgage interest.

Web The mortgage interest deduction is a tax incentive for homeowners. Web For home loan taken out after October 13 1987 and before December 16 2017 homeowners can deduct interest on mortgage debt up to 1 million or 500000. Mortgage interest paid on a second residence used.

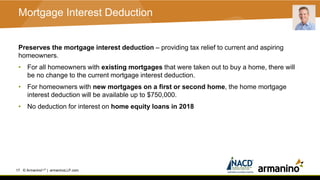

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Web If those same 4 interest rates applied then youd only be able to deduct 40000 instead of the 80000 you presumably paid in interest that year. This itemized deduction allows homeowners to subtract mortgage interest from their.

Answer Yes and maybe. Web Most homeowners can deduct all of their mortgage interest. Web The home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of their loan.

Pub 936 says if all mortgages fall in one. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Ad Compare Loan Options Calculate Payments Get Quotes - All Online.

Reviews Trusted by 45000000. Web Mortgage Interest Deduction The first tax deduction you may take for your second home is the mortgage interest deduction. Homeowners who bought houses before.

This new law only applies to homes purchased after Dec. We dont make judgments or prescribe specific policies. Compare 2023s Top Second Mortgage Rates Save Today.

See what makes us different. 3 after Dec 16 2017 and under 750k. Although this limit doesnt apply to legacy.

Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. As stated above you qualify for the mortgage deduction if your second home meets the requirements and you live in it for the greater of. Web Under the new tax law homeowners can only deduct mortgage interest paid on up to 750000 on a first or second home.

Web If your total principal amount outstanding is 750000 375000 if married filing separately or less you can deduct the full amount of interest paid on all mortgages for a main or second home so long as the mortgages were used for acquisition indebtedness as described above in question one. Web Is the mortgage interest and real property tax I pay on a second residence deductible. Web Pub 936 defines 3 categories.

Web Generally for the first and second categories you can deduct mortgage interest on up to 1 million 500000 for those married filing separately. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Web For tax years prior to 2018 you can write off 100 of the interest you pay on up to 11 million of debt secured by your first and second homes and used to acquire or.

Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than.

Aquasynthesis Again Splashdown Vol 2 Warren Fred Bridges Grace Warren Fred Tolbert Robynn Carroll Kessie Jones Mary Brock Mclain Robert Perry Travis Creed Frank Creeden Pauline Amazon De Books

People S Republic Of China 2022 Article Iv Consultation Press Release Staff Report And Statement By The Executive Director For The People S Republic Of China In Imf Staff Country Reports Volume 2023 Issue 067 2023

Deduct Mortgage Interest On Second Home

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

The Volatility Mismatch Theory Of Housing Supply And Demand And House Price Instability Real Estate Decoded

Can I Take The Home Mortgage Interest Deduction On More Than One House

Can You Deduct Mortgage Interest On A Second Home Moneytips

Mortgage Interest Deduction A Guide Rocket Mortgage

Armanino Webinar Tax Reform Is Here What You Need To Know 010118

These Are The Countries With The Biggest Debt Slaves And Americans Are Only In 10th Place Wolf Street

Can You Deduct Mortgage Interest On A Second Home Moneytips

See How Well Your Mortgage Interest Deduction Stacks Up Compared To The Rest Of The Country

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

:max_bytes(150000):strip_icc()/InterestDeductions-0c6d98dac2c64b9a93c07d8078ae5fdd.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

Armanino Webinar Tax Reform Is Here What You Need To Know 010118

The Gc Homes Team Real Estate Greece Ny

Why The Housing Market Won T Crash Any Time Soon